THE CALLENGE

Managing payment runs and reconciliation manually was a daily headache

Berlin-based Banxware is one of Europe’s fastest growing embedded lending platforms. High-profile partners like Fiserv and Just Eat Takeaway use Banxware to provide fully-managed financing online to their customers in a matter of minutes – but the real secret to its success is a white-label, near-instant lending experience that borrowers love. Their key payment and treasury operations include:

- Approving and paying out loans to small businesses, sole traders, freelancers, and sub-merchants

- Collecting and reconciling direct debit payments and managing errors

- Managing cash and liquidity across multiple banks, including monitoring balances and making internal transfers

One of Banxware’s key differentiators versus traditional lenders is its speed and efficiency. But behind the scenes, its lean finance team were spending 20 hours per week at a minimum on manually initiating, monitoring, and reconciling payments. The reconciliation process alone involved matching bank statements to internal records line by line with the team bogged down in spreadsheets and bank portals.

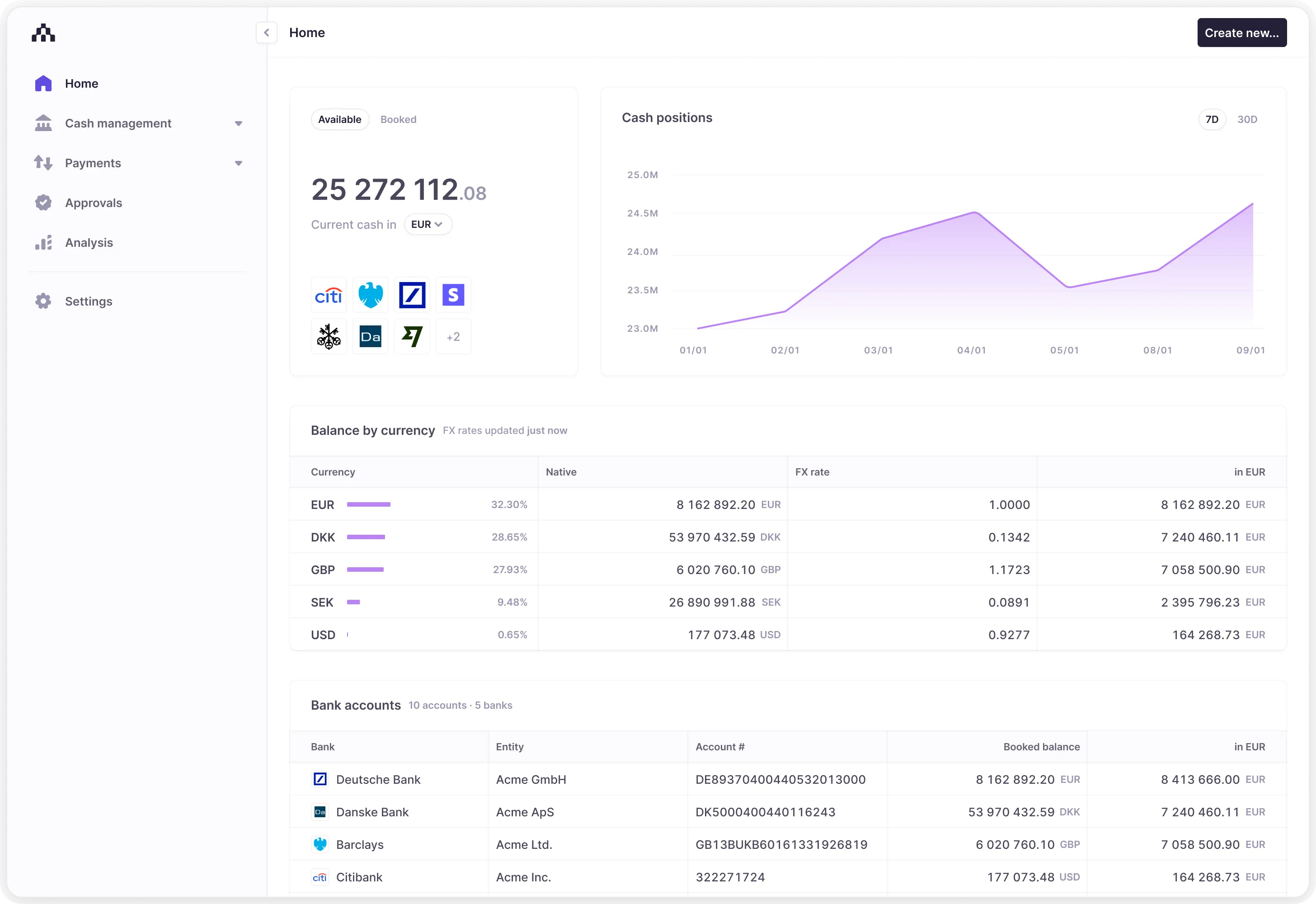

The lack of a central source-of-truth for transaction and balance data made the team’s treasury operations a struggle too. Tracking cash balances and monitoring liquidity across banks is a key part of the finance team’s work, but as the business grew this became siloed in multiple bank portals with team members lacking the visibility and controls to manage liquidity effectively.

Having to integrate, configure, and then manage new banks whenever Banxware launched in a new market was a major drain on both the finance and engineering team. With each bank needing to be integrated sequentially it slowed time-to-market and consumed more and more resources as the business expanded, lessening the time spent on improving the core product.

It was clear to Banxware’s finance team that their traditional, manual processes had the potential to put the brakes on the company’s growth with more and more business entities, banks, and accounts to manage. ‘Team members had to spend hours in online bank portals doing the same manual, repetitive tasks over and over,’ says Nicolas. ‘We knew there had to be a better way.’

The finance function was keen to refocus on work of higher value to the business as it scaled to new markets – like optimising its cash and generating insights for management – and free up engineering resources at the same time. The team needed modern tooling and workflows to match their ambitions.

THE SOLUTION

Automated payment workflows, faster approval chains, and full visibility over incomings and outgoings

Banxware partnered with Atlar to automate payments and reconciliation end-to-end, improve collaboration and approval workflows, and simplify cash management.

Having evaluated several providers, the team chose Atlar due to our connections to banks across Europe, the ability to consolidate PSP and ERP data, and user-friendly API for end-to-end payment automation. Banxware automated its core payment flows in just two weeks, supported by features like robust approval chains, live payment status tracking through webhooks, and custom logic for edge cases and audit trails.

Faster money movement quickly resulted in faster lending experiences. Automating and processing transactions in real time with Atlar – instead of manually initiating payments with every bank – means borrowers can access funds in seconds rather than minutes. Banxware’s partners see the benefits of this too in higher customer satisfaction and increased engagement on the platform.

Loan repayments have been radically simplified too. Banxware now uses the Atlar API to set up direct debit mandates, automatically collect repayments, and receive live notifications for chargebacks. Handling edge cases and reconciling incoming payments is faster and less manual, since the team has full visibility over the underlying transaction data at all times.

While the team no longer needs to manage each and every bank payment, Banxware’s risk analysts do occasionally need to review and approve transactions to manage credit risk. Team collaboration around approvals is now much simpler and the risk of human error reduced. The Atlar dashboard gives the quick, comprehensive insights the risk team needs to make decisions thanks to consolidated data from all banks, search tools, and approval chains aligned to internal policies.

Operational treasury work is less of a hassle too. The team gained full visibility and control over its bank accounts across multiple markets with cash and transaction reporting centralised in one place instead of separate, siloed bank portals. This has simplified Banxware’s cash management workflows and ultimately helped the finance function better support the company’s future growth.

THE RESULT

Almost all payments and treasury busywork automated, plus a foundation for accelerated market expansion

The levelling up of Banxware’s financial operations ultimately resulted in a shorter time-to-market for the business as it expands through Europe. With Atlar's pre-built banking connectivity, Banxware can orchestrate all their current and future banking partners through a single API and dashboard, enabling their ambitious growth plans as a leader in embedded lending.

Banxware’s recent launch in the Netherlands, shortly after integrating Atlar, shows the finance team’s newfound speed and nimbleness. Integrating new banking partners no longer takes weeks and there’s no extra setup or change management required from the finance team. ‘Integrating Atlar into our existing workflows has removed all the complexity around multi-bank and multi-currency setups – meaning we can scale our financing platform faster,’ adds Nicolas.

The business is now in a stronger position to support more customers, in more markets, with even more efficient lending experiences – all of which was delivered by Banxware’s finance team. ‘Automating payments and treasury with Atlar will be a massive accelerator for us moving forward,’ says Nicolas. ‘We’ve already launched our operations in a new country in just a few short weeks with more markets to come.’

Keen to see why modern finance teams are making the switch to Atlar? Book a demo and get a guided tour of the platform.